3 Easy Facts About Clark Wealth Partners Explained

Table of ContentsThe Buzz on Clark Wealth PartnersNot known Incorrect Statements About Clark Wealth Partners 10 Simple Techniques For Clark Wealth PartnersSee This Report on Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.The Single Strategy To Use For Clark Wealth PartnersThe Definitive Guide for Clark Wealth Partners

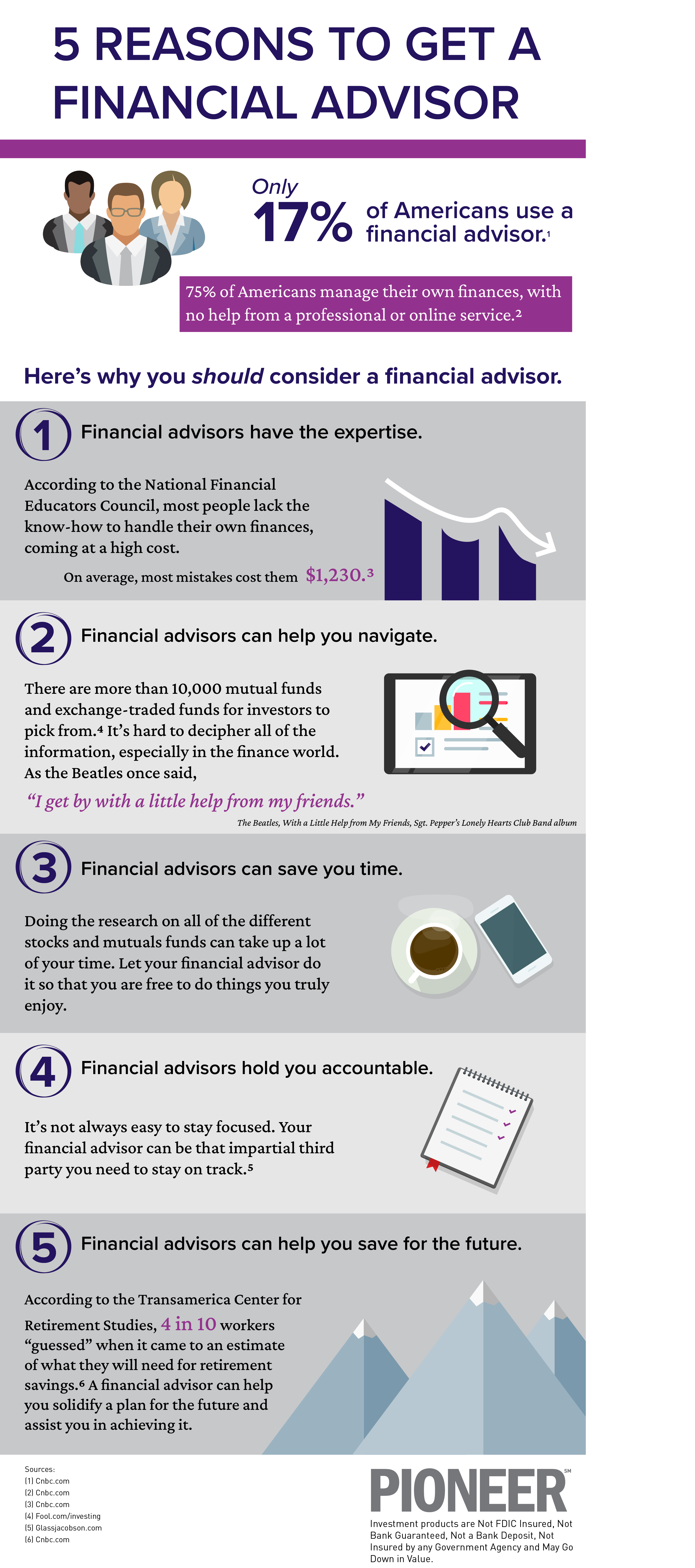

These are professionals that provide investment recommendations and are registered with the SEC or their state's securities regulatory authority. Financial advisors can likewise specialize, such as in trainee financings, elderly needs, taxes, insurance coverage and various other facets of your financial resources.Just financial experts whose classification calls for a fiduciary dutylike licensed financial organizers, for instancecan state the exact same. This distinction also suggests that fiduciary and financial advisor cost structures vary as well.

Fascination About Clark Wealth Partners

If they are fee-only, they're more most likely to be a fiduciary. Numerous credentials and designations call for a fiduciary responsibility.

Choosing a fiduciary will guarantee you aren't steered towards particular financial investments because of the commission they use - financial advisor st. louis. With lots of money on the line, you may desire a monetary expert that is legitimately bound to use those funds very carefully and just in your ideal passions. Non-fiduciaries might advise financial investment products that are best for their pocketbooks and not your investing objectives

The Clark Wealth Partners Statements

Boost in cost savings the average house saw that functioned with a financial consultant for 15 years or even more compared to a similar home without a monetary expert. "Extra on the Value of Financial Advisors," CIRANO Project Information 2020rp-04, CIRANO.

Financial advice can be beneficial at turning factors in your life. Like when you're beginning a family, being retrenched, intending for retired life or taking care of an inheritance. When you satisfy with an advisor for the very first time, exercise what you wish to obtain from the recommendations. Prior to they make any kind of referrals, an advisor needs to take the time to discuss what is very important to you.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Once you've consented to go on, your financial advisor will prepare a monetary prepare for you. This is provided to you at one more conference in a paper called a Statement of Advice (SOA). Ask the consultant to explain anything you don't comprehend. You ought to always really feel comfortable with your consultant and their suggestions.

Firmly insist that you are informed of all transactions, and that you receive all communication pertaining to the account. Your advisor may right here recommend a taken care of optional account (MDA) as a means of managing your investments. This involves signing an agreement (MDA contract) so they can acquire or market investments without needing to contact you.

Some Known Details About Clark Wealth Partners

Prior to you buy an MDA, contrast the advantages to the expenses and dangers. To shield your money: Do not provide your consultant power of attorney. Never authorize an empty document. Place a time limitation on any authority you offer to deal investments on your part. Urge all document regarding your financial investments are sent out to you, not simply your advisor.

If you're relocating to a brand-new advisor, you'll need to organize to transfer your financial records to them. If you require aid, ask your consultant to explain the process.

To fill their shoes, the nation will certainly require even more than 100,000 new financial advisors to get in the industry.

An Unbiased View of Clark Wealth Partners

Assisting people attain their monetary goals is a financial expert's key feature. Yet they are likewise a tiny organization proprietor, and a section of their time is dedicated to handling their branch workplace. As the leader of their method, Edward Jones economic experts require the leadership skills to hire and manage staff, as well as the business acumen to develop and carry out an organization approach.

Spending is not a "collection it and neglect it" activity.

Financial advisors must set up time each week to meet brand-new people and capture up with the individuals in their sphere. Edward Jones financial advisors are fortunate the home office does the hefty training for them.

The Clark Wealth Partners Ideas

Edward Jones monetary consultants are encouraged to pursue additional training to broaden their knowledge and skills. It's also an excellent idea for economic consultants to go to industry meetings.